When it comes to large sums of money, there are plenty of potential obstacles to a sale.

As owner/operators who have run a very busy brokerage out of San Carlos, Sonora for five years, we have negotiated over 100 boat sales. We work with a diversity of buyers and sellers, engaging closely with all parties to best represent the interests of all involved. The ultimate goal, from our perspective, is that everyone is fully informed all throughout the process, allowing each party to make the best decision for them: to either complete the sale or to walk away if the deal is not right for them.

» Prefer to watch a video instead of read? We’ve got you! Captain Josh breaks down this secret tip (and how to use it) in our latest video on YouTube in under 18 minutes. Check it out here:

To clarify what some of these obstacles may be, here is a list of five boat negotiation scenarios we have dealt with:

Scenario 1: The non-starter

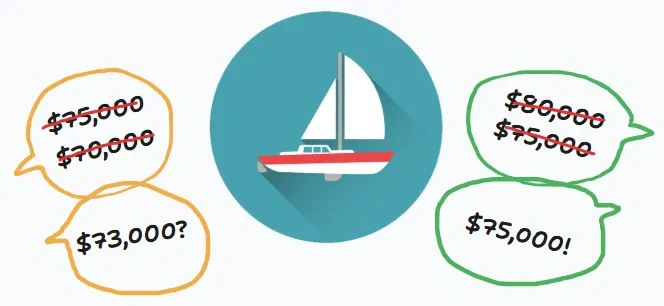

This situation arises when a buyer comes in at the upper limit of their offer, and the seller’s bottom limit is above it. To both sides, it feels like there are no more roads and each side will have to bow out.

Scenario 2: The “as is, where is”

The boat seller has placed limitations on the sale process, usually in the form of prohibiting a sea trial. For many boats for sale that are sitting on stands in dry storage, depending on how long they’ve been out of the water, there is quite an investment of time and expense that is required to get them in suitable condition for splashing. And since a buyer can still walk away after a sea trial, it is a tangible risk for the seller and, for some, not a risk they are willing to take.

This can make buyers understandably more nervous, but still willing to proceed with purchase. However, they may give a lower offer to account for the higher risk they are taking. Many sellers understand that this can happen, but still have a limit to how low they can go. And so, we are again at the apparent impasse we saw in Scenario 1.

Scenario 3: Personal inspection and re-negotiation

When a seller has accepted an initial offer, the buyers may not have had a close look of the vessel when the offer was made. After then going aboard and performing a bit of a deeper personal inspection of the vessel, it’s equipment and so forth, they may discover some issues they were not previously aware of or expecting that they know will require spending money right away to correct. Following this discovery, and before they spend money on a yacht survey, they need to get the boat price lower to account for the problems they’ve identified. And in this scenario, the buyer and seller are unable or unwilling to meet in the middle.

Scenario 4: Post-survey re-negotiation

It often happens after a buyer has made their initial offer and proceeded to complete their independent survey and/or sea trial of the vessel that the report comes back with some bigger issues than they initially realized. As such, knowing the expense that will be incurred to make corrections, they wish to re-negotiate their initial offer price to account for those costs. And while the seller may acknowledge the boat’s status and come down in price, in this scenario, there is still a gap between the two parties.

Scenario 5: Condition of repairs

In our previous scenario, there were some identified deficiencies with the vessel and both buyer and seller made adjustments but were still unable to meet on price. In this scenario, the seller has committed to effecting repairs. The buyer is willing to come up in price, but still needs to leave themself some room in case of any issue with the repairs. The buyer appreciates the seller’s position, but knows it is a buyer’s market. The impasse remains.

In yacht brokerage transactions, minor pricing gaps – such as the $2,000 variance in our example deal – between buyer and seller could potentially be reconciled through commission adjustment. Brokers, whose commission is typically 10% of the sale price, may elect to reduce their commission to facilitate deal completion, recognizing that partial remuneration is preferable to none.

The considerations they give to making this determination include knowledge of any inherent market uncertainties and their own operational expenditures, such as Yachtworld subscriptions, digital and print advertising, travel and administrative overhead.

Therefore, this practice is not a given in every situation, but a tool to be employed judiciously, contingent upon specific circumstances. The broker’s fiduciary responsibility is to act in the best interest of each party to facilitate a successful transaction where feasible.

As a buyer, if you find yourself in one of these familiar negotiation scenarios, it is our desire to enlighten you that this option may be available. You should not be hesitant to (respectfully) engage brokers in discussions regarding commission structure flexibility to bridge reasonable negotiation gaps that lead to the satisfactory closure of a deal.

When this “secret” strategy may not work

Just as we laid out five scenarios where this negotiation maneuver to complete a sale might make sense, there are situations when it equally may not make sense for the broker to do this, and it is helpful to know about them.

#1 Split Commissions

When there are two brokers involved in a sale, split commissions come into play. This means that the listing broker is already reducing their commission in order to make a sale. In this situation, unless both the buying and listing brokers are willing to take further reductions to their commission, this tactic will likely not be considered.

#2 Seller’s Market

Highly desireable boats will always have an upperhand in the market, selling sooner rather than later. In this situation, taking a cut to make a sale is an act of desperation that simply isn’t required, as the broker is confident they can find the right buyer in good time.

#3 Low Value Vessel

Boats selling for under $50,000 often face their own obstacles to a sale. They tend to be some of the older boats on the market, smaller, and have more than one known issue to resolve (hence the lower asking price). These conditions make the boat much harder to find a buyer for, while simultaneously attracting a lot more “keel kickers” who are hoping to find that diamond-in-the-rough. These listings also often trigger the broker’s minimum commission amount, which brokers set in the listing agreement to ensure they cover their costs.

So for the increased effort involved on behalf of the broker and the minimum commission threshold being met, it is unlikely the broker would be able to make concessions out of their own pocket for a sale.

As a final note, remember that not all brokers are equal in that they may not have before considered that a small reduction on their end could bring a fruitful conclusion to the right deal. So it is perfectly appropriate to discuss the potential of applying this strategy with your broker if you should find yourself in one of the situations we have discussed here, and potentially save yourself $1000s on your next purchase or sale.